Real estate investing can be a rewarding endeavor, but selecting the right city is vital for maximizing your returns. You need to assess various factors such as economic stability, population growth, and market trends to identify the most promising locations. In this guide, you will discover insightful steps that will empower you to make informed decisions and uncover lucrative real estate opportunities in cities that align with your investment goals. Let’s examine the crucials for evaluating the best cities for your real estate ventures.

Types of Real Estate Investment Opportunities

To navigate the vast landscape of real estate investing, it’s necessary to familiarize yourself with the different types of investment opportunities available. Each category presents unique advantages and considerations that can align with your financial goals and risk tolerance. Below is a summary of various types of real estate investments:

| Type | Description |

|---|---|

| Residential Properties | Properties designed for people to live in, including single-family homes, apartments, and condos. |

| Commercial Properties | Properties intended for business purposes, such as office buildings, retail spaces, and shopping centers. |

| Industrial Properties | Properties used for manufacturing, production, and storage of goods. |

| Vacant Land | Undeveloped land that can be held for appreciation or developed in future. |

| Real Estate Investment Trusts (REITs) | Companies that own, operate, or finance income-producing real estate. |

Recognizing the type of investment that aligns with your objectives is necessary to your success in the real estate market.

Residential Properties

The realm of residential properties offers a wealth of investment options, making it one of the most popular niches for investors. This category includes single-family homes, multifamily units such as duplexes, and larger apartment complexes. Generally, the rental income from these properties can provide steady cash flow, while property appreciation can add to your overall wealth over time. Many investors choose residential properties due to the relative ease of understanding market dynamics and tenant needs.

In addition to direct rental income, residential properties often benefit from tax deductions related to mortgage interest and property depreciation. You also have the opportunity to add value through renovations or strategic management practices, enhancing your investment’s profitability. Thus, investing in residential properties can be a beneficial starting point for those new to real estate investing.

Commercial Properties

Any investor looking for higher income potential may consider commercial properties. These assets, which include office buildings, retail centers, and warehouses, typically command higher rents compared to residential options. The lease agreements for commercial properties are often longer, which can lead to increased stability in rental income over time. Additionally, tenants are usually responsible for many operational expenses, allowing you to maximize your returns.

Types of commercial properties can range from small storefronts to large corporate buildings, thus offering various levels of investment and risk. However, it’s necessary to conduct thorough market research, as factors such as location, demand for specific types of commercial space, and economic conditions can significantly influence your investment’s success.

Industrial Properties

If you’re considering industrial properties, you are tapping into a sector that has been gaining traction in recent years. This category includes warehouses, distribution centers, and manufacturing facilities, all of which play a vital role in supporting the economy. Investing in industrial properties can offer attractive lease yields, as companies often require ample space for their operations. As e-commerce continues to expand, the demand for logistics and storage facilities has been on the rise.

Real returns on industrial properties can be quite promising, particularly in areas that are experiencing growth in manufacturing and logistics. Pay attention to market trends related to warehouse locations and transportation infrastructure as they can greatly influence your investment’s potential.

Key Factors to Consider

Any real estate investor must take into consideration various factors that influence the success of their investment. By evaluating these factors thoroughly, you can make informed decisions about where to invest your resources. Below are some key considerations when assessing potential cities for real estate investment:

- Economic indicators

- Population growth and demographics

- Real estate trends

- Local infrastructure and amenities

- Regulatory environment

Knowing how these elements interact can guide you towards more promising investment opportunities.

Economic Indicators

You should closely examine economic indicators when evaluating cities for real estate investments. Metrics such as employment rates, income levels, and GDP growth can provide insight into the overall economic health of an area. A vibrant job market often correlates with increased demand for housing, making it necessary to look for cities with robust economic prospects.

Additionally, consider the diversity of the local economy. Cities that rely heavily on a single industry may face risks during economic downturns, while those with a more varied economic base often show greater resilience. Keeping an eye on these factors will help you identify cities likely to experience ongoing growth, driving demand for real estate.

Population Growth and Demographics

Now, you need to pay attention to population growth and demographics, as these factors greatly influence housing demand. A rising population typically leads to increased demand for rental properties and homes for sale. Evaluate trends in migration, both domestic and international, and determine whether the area is experiencing population influxes or declines, which can significantly impact your investment’s success.

Demographics also play a vital role; understanding the age distribution, income levels, and household types in the region can help you tailor your investment strategy. Areas with growing young professional populations may favor rental properties, while family-oriented demographics might indicate a need for single-family homes.

Consider the potential for future growth by assessing local developments, such as infrastructure projects and business expansions, as these can directly influence demographic shifts. Knowing where people want to live is half the battle in real estate investment.

Real Estate Trends

Estate trends are necessary in shaping your investment strategy and identifying promising markets. Analyze current market conditions, including inventory levels, average days on the market, and the ratio of homes sold to listings. This data will reveal whether the market is favoring buyers or sellers, giving you insights into potential investment timing. Furthermore, you should explore the historical trends in property values to understand past fluctuations and predict future behavior.

Economic conditions can also impact real estate trends significantly. Rising interest rates, for example, can deter buyers, potentially affecting property values. Understanding how external factors shape the market will empower you to make timely investment decisions. Lower inventory and high buyer demand often lead to appreciating property values, making it vital to seek cities that currently reflect these trends.

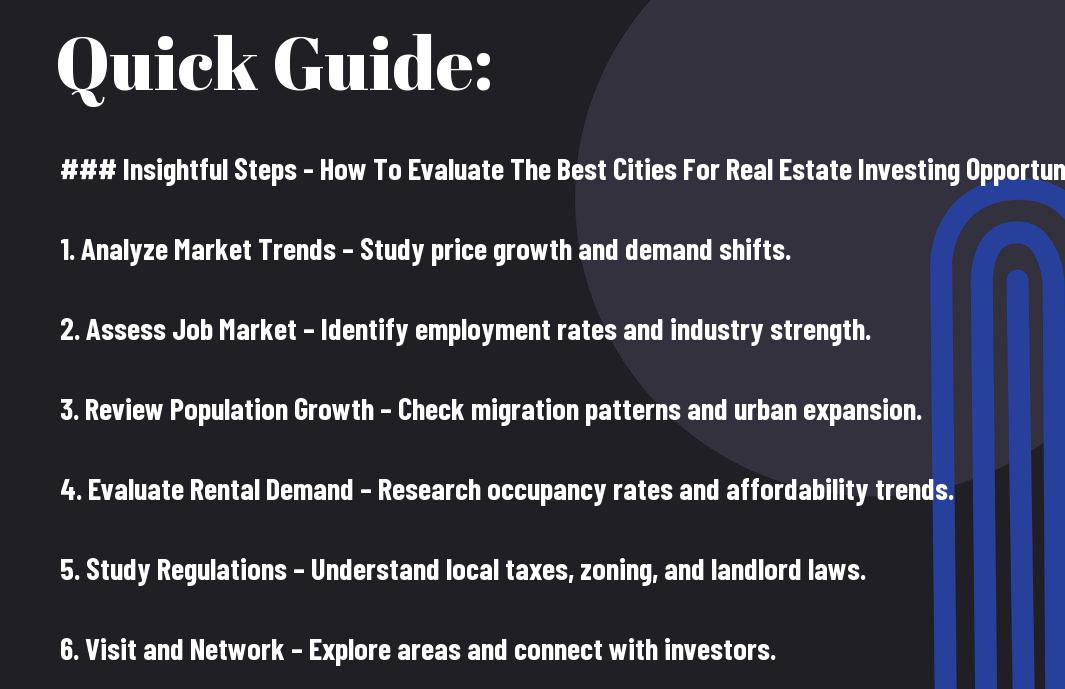

Step-by-Step Guide to Evaluating Cities

Many aspiring real estate investors often struggle with pinpointing the cities that offer the most lucrative opportunities. However, by following a step-by-step guide to evaluating cities, you can make informed decisions that align with your investment goals. This process involves analyzing economic factors, market trends, and demographic data to determine which cities will yield the highest returns on your investment. By systematically breaking down your evaluation process, you’ll feel more confident about your choices in the competitive real estate market.

Research Methodology

| Step | Description |

| 1. Identify Goals | Define your investment objectives, such as cash flow or property appreciation. |

| 2. Gather Data | Collect information on various cities, focusing on crucial economic indicators and demographics. |

| 3. Analyze Trends | Examine historical data to identify favorable market trends and potential growth areas. |

| 4. Consult Experts | Engage with local real estate professionals for on-the-ground insights and recommendations. |

Research Methodology

You should start your evaluation by identifying your investment goals. This may include seeking consistent cash flow or focusing on long-term property appreciation. Deciding on your priorities will guide you in selecting the right metrics and data points to study. Following this, gather data on potential cities, taking note of important economic indicators like job growth, population trends, and housing demand. Ensure you factor in any unique local attributes that could influence real estate profitability.

Furthermore, analyzing historical trends will provide context for current data and help in understanding market fluctuations. Utilize resources such as census information, real estate reports, and economic studies to obtain a comprehensive picture of each city under your consideration. Consulting local real estate experts can also provide nuanced insights that raw data cannot convey, ensuring a well-rounded evaluation.

Analyzing Data and Metrics

Data plays a significant role in your evaluation process. By utilizing various metrics, including median home prices, vacancy rates, and rental yields, you can glean valuable insights about a city’s real estate market. Analyzing these data points will allow you to compare the potential profitability of various locations. Don’t overlook qualitative data as well; local community amenities, schools, and crime rates can considerably impact the desirability of real estate in your selected cities.

Guide your analysis by focusing on both historical data and current market conditions. An increase in demand, coupled with a sustainable job market and population growth, often indicates a healthy real estate environment. Basic metrics such as price-to-rent ratios and days on market should also factor into your overall decisions, forming a more comprehensive picture of potential cities.

Making Comparisons

Some cities might initially seem appealing based on surface data, but making thorough comparisons can reveal the best investment opportunities. Create a comparison matrix with crucial metrics to evaluate how each city stacks up against the others. This will allow you to visualize your data more effectively and highlight the strengths and weaknesses of potential cities. Remember to include soft metrics like neighborhood safety, school ratings, and quality of life, as they play an integral role in long-term investment viability.

Comparison Table

| City | Key Metric |

| City A | 6% rental yield |

| City B | 3% population growth |

| City C | 8% year-on-year price appreciation |

| City D | 2% unemployment rate |

Evaluating the comparisons you create gives you a more detailed insight into the overall market landscape. You may find that one city excels in rental returns while another offers superior appreciation potential. By aligning your evaluations with your specific investment goals, you can enhance the probability of success in your real estate endeavors.

Evaluation Metrics Table

| Metric | Importance |

| Rental Yield | Indicates cash flow potential for investors. |

| Population Growth | Reflects future demand for housing. |

| Appreciation Rate | Shows the potential increase in property value over time. |

| Employment Rate | Supports economic stability and housing demand. |

Tips for Identifying the Best Cities

For successful real estate investing, identifying the best cities requires thorough research and a strategic approach. To pinpoint optimal locations for investment, you should consider a variety of factors that indicate a city’s potential for growth and stability. Focused analysis can be broken down into key areas, including economic trends, population growth, crime rates, and local regulations affecting property investment. Here are some helpful tips to guide your evaluation:

- Analyze the job market and major industries in the area.

- Examine recent population growth and demographic trends.

- Consider the cost of living and property prices compared to local incomes.

- Research any upcoming infrastructure projects or developments.

- Investigate the rental market to assess demand for rental properties.

Recognizing these factors will provide you with a comprehensive framework for evaluating potential markets.

Local Market Knowledge

The foundation of successful real estate investing is local market knowledge. It’s necessary to familiarize yourself with the intricacies of the area where you plan to invest. This includes understanding the historical performance of the real estate market, identifying key neighborhoods, and keeping an eye on zoning changes or property regulations. Local knowledge equips you with the insights needed to make informed decisions that align with your investment strategy.

Furthermore, you should keep track of emerging trends, such as shifts in housing preferences or changes in household formations. Being well-versed in these dynamics gives you an edge over other investors and positions you to capitalize on opportunities as they arise.

Networking and Resources

Networking plays a pivotal role in your quest for successful real estate investments. Engaging with local real estate professionals, investors, and community leaders allows you to gather valuable insights and experiences that can enhance your understanding of the market. Establish relationships with real estate agents, property managers, and investors who can provide you with firsthand advice and guidance. Attending real estate seminars, workshops, and local meet-ups can help you expand your network and uncover promising investment opportunities.

Resources available online can also aid your research efforts. Explore market analysis reports, real estate investment platforms, and local government websites where you can access necessary data. Leverage webinars and podcasts dedicated to real estate investing, as they often feature industry experts sharing their insights and strategies.

Timing the Market

There’s a delicate balance in timing the market to maximize your investment returns. Observing trends in property prices and rental rates will help you determine the right moment to enter a market. Additionally, keep an eye on economic indicators such as unemployment rates and GDP growth, as these factors can greatly influence property demand. Conducting a thorough analysis of seasonal patterns in the real estate market can also help you identify the best times to buy or sell.

Another important consideration is understanding the cyclical nature of real estate markets. Markets typically go through phases of expansion, peak, contraction, and recovery. By recognizing where the market stands in this cycle, you can make decisions that align with the current economic landscape, ultimately guiding you towards more successful investments.

Pros and Cons of Real Estate Investing in Different Cities

After evaluating various factors that can influence your success in real estate investing, it’s important to weigh the pros and cons of different cities. Each market has its unique landscape that presents both opportunities and challenges, so understanding these can help you make informed decisions. The following table outlines some advantages and drawbacks of real estate investing across various city types:

| Pros | Cons |

|---|---|

| High rental demand | Property prices may be inflated |

| Diverse investment opportunities | Higher competition among investors |

| Strong job market | Economic downturns can impact property values |

| Established infrastructure | Higher taxes and regulations |

| Predictable cash flow | Limited potential for rapid appreciation |

| Access to amenities and services | Potential for tenant turnover and management issues |

| Strong community ties | Resilience against market fluctuations is necessary |

| Lower vacancy rates | May require significant capital |

| Long-term appreciation potential | Market saturation can affect profitability |

| Great resale value | High-maintenance costs in established areas |

Advantages of Established Markets

On focusing your investment pursuits in established markets, you’ll find that many of these regions offer inherent advantages that can help you achieve your goals. For instance, cities with a long-standing reputation typically boast strong rental demand, providing you with a more reliable source of income. Their mature infrastructure and services can lead to greater tenant satisfaction, resulting in lower vacancy rates and more stability in your cash flow. These markets tend to attract a more diverse population, including professionals relocating for jobs, which further enhances your investment opportunities.

Moreover, investing in established markets often offers a certain level of predictability in financial returns. This stability can be particularly appealing if you’re looking for long-term appreciation potential. The historical data on property values in these areas can give you added confidence in your investment decisions. Established cities also usually have a well-defined regulatory framework, making it easier for you to navigate the complexities of property ownership and land use.

Risks of Emerging Markets

Estate investing in emerging markets can offer high rewards, but it’s important to note that these opportunities come with increased risks. You may be enticed by lower property prices and the potential for rapid appreciation, yet these areas may lack established demand and infrastructure reliability. This unpredictability can translate into higher vacancy rates, giving way to financial losses and extended periods of uncertainty. Furthermore, you could face challenges related to property management and maintenance, as emerging neighborhoods may not have the same level of resources as their more established counterparts.

Understanding the landscape of emerging markets is key. Many areas may be undergoing transition, which can involve economic fluctuations that affect property values adversely. Local regulations may also be in flux, complicating your investment strategy. Thoroughly researching the area and its growth projections can help you mitigate these risks, but keep in mind that investing in emerging markets often requires a greater level of involvement and adaptability to external changes.

Summing up

Ultimately, evaluating the best cities for real estate investing opportunities requires a strategic approach that combines thorough research and analytical skills. You need to assess various factors such as economic growth, population trends, rental demand, and local market conditions to identify cities that align with your investment goals. By leveraging tools like market reports and demographic studies, you can better understand the nuances of each location, guiding you toward making informed decisions that maximize your return on investment.

In your pursuit of lucrative real estate opportunities, it’s vital to stay updated on market fluctuations and be adaptable in your strategies. Engaging with local experts, attending property expos, and networking with other investors can provide valuable insights and complement your analysis. Ultimately, your proactive approach and careful evaluation of potential markets will put you on the path to finding rewarding real estate investments that could yield significant returns over time.