Just initiate on your journey to becoming a savvy real estate investor by learning how to identify high-potential properties that promise substantial returns. This guide equips you with imperative strategies and insights to analyze market trends, evaluate property characteristics, and assess neighborhood dynamics effectively. Whether you’re a seasoned investor or a newcomer, you’ll gain the knowledge necessary to make informed decisions that align with your financial goals. Get ready to transform your investment approach and uncover opportunities that can elevate your portfolio.

Types of High-Potential Real Estate Investments

Your success in the real estate market often hinges on identifying the right types of investments. Each category of real estate offers unique opportunities and risks, and understanding these distinctions can significantly enhance your investment strategy. Here’s a breakdown of the main types of high-potential real estate investments you might consider:

| Type of Investment | Characteristics |

|---|---|

| Residential Properties | Stable cash flow, increasing demand, long-term appreciation potential. |

| Commercial Properties | Higher income potential, longer lease terms, more complex management. |

| Mixed-Use Developments | Diverse revenue streams, enhanced community engagement, potential for urban growth. |

| Raw Land | Flexible development options, potential for future appreciation, requires due diligence. |

| Real Estate Investment Trusts (REITs) | Liquidity, passive income, diversified portfolios without ownership of property. |

Thou should explore each of these options in depth to identify which aligns best with your investment goals.

Residential Properties

Any investor looking to enter the real estate arena often starts with residential properties, as they provide a familiar backdrop and myriad opportunities. Single-family homes, condominiums, and multifamily units are all part of this category. Typically, these types of properties are in high demand due to the housing needs of the population. With a focus on location, quality, and community desirability, residential properties can yield solid returns through appreciation and rental income.

Furthermore, investing in residential properties can often provide tax incentives and mortgage deductions, which contribute to overall profitability. You can analyze market data to select areas with potential growth and stability, ensuring your investments remain resilient over time.

Commercial Properties

Investments in commercial properties can significantly expand your investment portfolio and income potential. This category includes office buildings, retail spaces, warehouses, and industrial units. Unlike residential units, commercial properties usually feature longer lease terms, which secure a steady cash flow for you over extended periods. Additionally, these properties often command higher rents per square foot compared to residential options, creating opportunities for attractive return on investment.

Properties in prime commercial locations can substantially appreciate in value due to increasing demand from businesses looking for strategic locations. As you venture into commercial properties, consider the market dynamics, zoning regulations, and levels of business activity in the area to ensure you make an informed decision.

Mixed-Use Developments

Commercial mixed-use developments blend residential, commercial, and sometimes industrial spaces to create vibrant communities. These projects are designed to foster a dynamic urban lifestyle, allowing residents to live, work, and play in proximity. With the continuous rise of suburban population and urbanization trends, you can capitalize on the diverse revenue streams that mixed-use properties can offer.

For instance, by revitalizing an emerging neighborhood with such developments, you not only attract residents but also local businesses, boosting your property’s value and its market demand. This format allows businesses to benefit from foot traffic while residents enjoy the convenience of various amenities, which exemplifies an investment strategy that adapts to modern living trends.

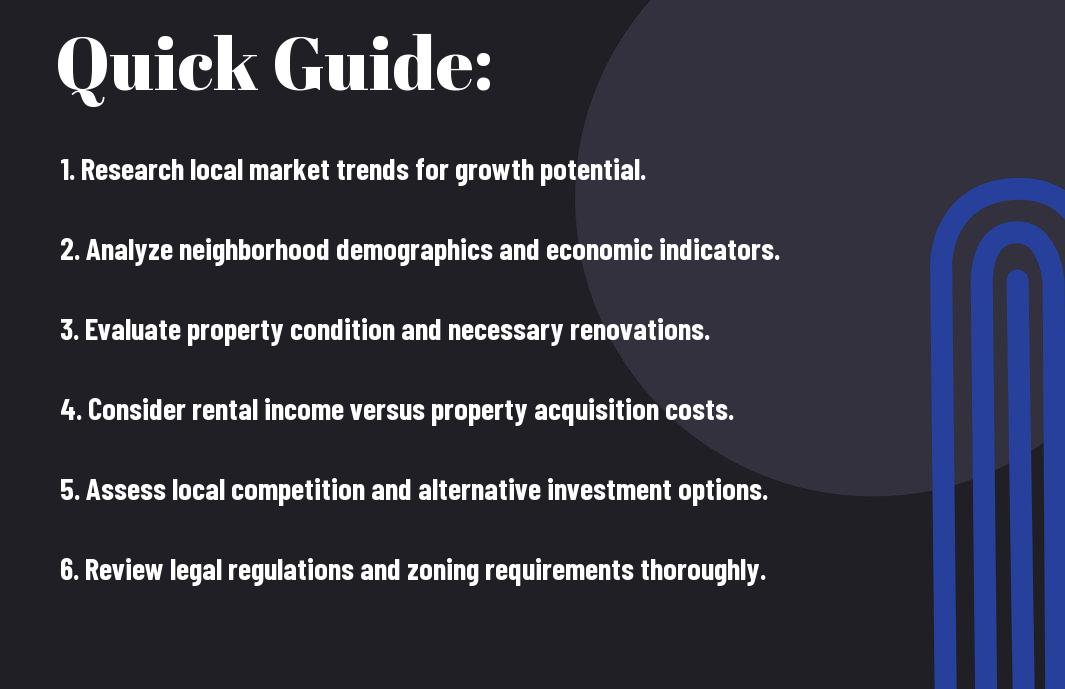

Key Factors to Consider

The world of real estate investment is multifaceted, and your ability to assess various factors can significantly influence your success. When identifying high-potential investments, consider the following key factors:

- Market trends

- Location analysis

- Property condition

- Financial metrics

- Potential for appreciation

Assume that you prioritize these elements as part of your investment strategy, and you’ll be better equipped to make informed decisions that align with your financial goals.

Market Trends

Little details can greatly shape the trajectory of your potential investments. Pay attention to market trends that reflect the economic landscape of the area you are considering. Factors such as employment rates, population growth, and housing demand can provide insight into the current and future value of real estate in a specific market. Additionally, monitoring shifts in consumer preferences—like the demand for urban versus suburban living—will equip you to make more informed investment choices.

Location Analysis

Factors such as neighborhood dynamics, proximity to amenities, and potential for future development play a significant role in location analysis. Evaluating these elements will guide you to properties with greater prospects for appreciation and better rental returns. Take the time to consider how local schools, transportation links, and community resources can affect property values.

Trends within specific neighborhoods can also offer insight into areas ripe for investment. Look for upcoming developments, infrastructural improvements, or planned community initiatives that could enhance the attractiveness of these locations.

Property Condition

Factors impacting property condition include structural integrity, age of the property, and necessary repairs or upgrades. Conducting a thorough inspection will help you determine whether a property will require significant additional investment to bring it to market standards. A well-maintained property can be an exceptional asset, while one needing frequent repairs could diminish your returns.

Location often dictates both the condition of a property and the potential need for renovations. Properties in more established neighborhoods may need less work to appeal to buyers or renters, while those in emerging areas may offer opportunities for value-add renovations that cater to changing demographic preferences.

Step-by-Step Guide to Assessing Investments

Once again, entering the world of real estate investing requires not only passion but also a systematic approach. This chapter will provide you with a structured methodology for evaluating potential investments. By following these steps, you can confidently assess opportunities in a way that aligns with your investment goals and risk appetite.

| Process | Description |

|---|---|

| Initial Research | Gather key data about the property, location, and market trends to form a preliminary assessment. |

| Financial Analysis | Evaluate the potential return on investment (ROI) through various financial metrics and models. |

| Due Diligence | Perform comprehensive checks and validations on the property to uncover any hidden issues. |

Initial Research

If you plan to make an informed decision, start with thorough initial research. This involves collecting relevant data about the property in question as well as its surrounding area. Investigate historical sales trends, current property values, and demographic information. Additionally, familiarize yourself with local amenities, economic conditions, and future development plans that could impact property desirability. The more knowledge you acquire during this phase, the better positioned you will be to spot promising investment opportunities.

Peering into online resources, engaging with local real estate agents, and utilizing investment platforms can enhance your findings. This information serves as the backbone for informed decision-making, allowing you to distinguish between properties that simply look appealing and those with sound investment potential. Set an objective to collect and analyze as much data as possible before moving to the financial analysis stage.

Financial Analysis

Guide yourself through the intricate realm of financial analysis by evaluating metrics such as cash flow, net operating income, and capitalization rates. Performing this analysis helps you understand the investment’s potential to generate income, thereby allowing you to project returns and assess overall viability. Focus on expenses that may not be immediately apparent, such as maintenance costs, property taxes, and property management fees, as these can significantly affect your bottom line.

Initial calculations should include your projected revenues compared to the anticipated costs. Running different scenarios can also shed light on best-case and worst-case outcomes, giving you a clearer picture of risk. This comprehensive financial assessment acts as a guide to help you make educated investment decisions and compare various opportunities effectively.

Due Diligence

Assuming you have identified a promising property and conducted preliminary analyses, your next step is to engage in due diligence. This process entails verifying all the facts about the investment that could influence its viability. This includes examining property title records, zoning laws, inspections, and possibly even speaking with local authorities to uncover any potential red flags. Thorough diligence protects you from unexpected challenges after the purchase.

Ensuring your due diligence is meticulous can save you from financial pitfalls and unfavorable situations in the future. It’s important to take a comprehensive approach and consider hiring professionals—such as inspectors, appraisers, or attorneys—when necessary to validate your findings. By investing time and resources into this phase, you strengthen your position as a knowledgeable buyer prepared to make sound decisions.

Diligence in your evaluations cements your confidence throughout the investment process. This thorough approach helps you foresee possible challenges and enhances your ability to negotiate effectively, ultimately contributing to achieving your long-term real estate investment goals.

Tips for Identifying Opportunities

Unlike the many investors who jump headfirst into property deals without adequate research, you can increase your chances of success by adopting a more deliberate approach. Begin by honing your analytical skills to recognize potential in various markets. Familiarize yourself with different neighborhoods and property types, and conduct an extensive analysis of recent sales trends and future projections. To help you spot opportunities, consider the following tips:

- Assess local economic indicators, such as job growth and population trends.

- Analyze property values and rental yields in various neighborhoods.

- Network with local real estate agents and attend community events.

- Explore off-market listings and foreclosure opportunities.

This will enable you to uncover hidden gems that others may overlook.

Networking and Relationships

Identifying high-potential real estate investments often relies on cultivating valuable relationships within your industry. By networking with local professionals including agents, brokers, and fellow investors, you can gain insights that are not readily available through public listings. These relationships can also lead to access to exclusive deals before they hit the market, giving you a distinct advantage.

Engaging in community events or joining real estate clubs will help you build your network further. As you establish rapport and trust with your connections, you’ll find that they can provide recommendations, share tips, and even collaborate on investment opportunities that may align with your goals.

Utilizing Technology

To improve your ability to identify high-potential properties, leverage technology to streamline your research and analysis. There are numerous websites and applications available that can assist in tracking market trends, analyzing property values, and even automating processes related to property management. The right tools can save you time and enhance your decision-making capacity by organizing vast amounts of data into easily digestible formats.

For instance, platforms such as Zillow or Redfin can provide you with immediate access to property listings, historical sales data, and neighborhood statistics, allowing you to make more informed assessments. Additionally, using GIS (Geographical Information Systems) can help you visualize market demographics and property characteristics, which can be necessary in identifying high-potential areas.

Staying Informed

The real estate market is ever-changing, and staying informed on the latest trends, regulations, and news is vital for making smart investment decisions. Subscribe to industry newsletters, follow relevant blogs, and engage with real estate podcasts to keep your knowledge sharp. By actively consuming information, you position yourself to act on opportunities as they arise and adapt your strategies to shifting market dynamics.

Understanding local laws and economic conditions will further empower you to make sound investments. When you grasp the nuances of your target market, you’re better equipped to identify emerging neighborhoods and capitalize on changes, ensuring that your investments continue to yield high returns in the long run.

Pros and Cons of Real Estate Investments

All investments come with their own advantages and disadvantages, and real estate is no exception. Understanding the pros and cons will help you make informed decisions when identifying high-potential opportunities in the market. Below is a breakdown of some key factors to consider:

| Pros | Cons |

|---|---|

| Potential for high returns | Market fluctuations can affect property value |

| Tax benefits and deductions | Initial capital investment can be significant |

| Cash flow from rental properties | Ongoing maintenance and management costs |

| Diversification of assets | Liquidity issues; it may take time to sell |

| Asset appreciation over time | Risk of tenant-related issues |

| Leverage options | Potential for foreclosure if unable to pay loans |

| Control over your investment | Requires ongoing research and market knowledge |

| Hedge against inflation | Time-consuming due to property management tasks |

Financial Benefits

An increasing number of investors are turning to real estate due to its potential financial advantages. One of the most appealing aspects is the ability to generate consistent cash flow through rental income, which can provide a steady stream of passive earnings. In addition to cash flow, properties typically appreciate over time, making them a long-term wealth-building strategy. The tax benefits associated with real estate investments can also enhance your overall returns, as you can often deduct mortgage interest, property taxes, and depreciation from your taxable income.

Investing in real estate gives you the potential to leverage other people’s money, particularly through mortgages, allowing you to purchase larger properties or multiple properties with a smaller amount of your own capital. This leverage can amplify your returns, should the property value increase. Overall, these financial benefits contribute to a compelling case for pursuing real estate as part of your investment strategy.

Risks Involved

Pros and cons come hand in hand, and while there are many financial benefits to investing in real estate, you must also be aware of the associated risks. Market fluctuations can have significant impacts on property values, and even a well-located property may not appreciate as expected. Additionally, the real estate market can be unpredictable, and economic downturns may lead to a decline in demand for rental properties, resulting in decreased cash flow and occupancy rates.

Plus, owning real estate can tie up a considerable amount of your capital, making it less liquid than other investment types. In some cases, unforeseen expenses, such as major repairs or tenant-related issues, may arise, further impact your financial returns. By understanding these risks, you can develop strategies to mitigate them, ensuring that your investments are both fruitful and sustainable in the long run.

Common Mistakes to Avoid

Many real estate investors fall into the trap of making common missteps that can significantly impact their success. While it’s easy to get caught up in the potential gains of a property, understanding the pitfalls can be the key to maximizing your investment strategy. By recognizing these mistakes, you can better position yourself to make informed decisions in the ever-changing real estate market.

Overconfidence

Any investor can find themselves distracted by overconfidence, believing they possess a firm grasp on the market and the prospects of individual properties. This hubris can lead to taking unnecessary risks, such as bypassing due diligence or overlooking important factors that may not align with your initial assessment. It’s vital to balance your intuition with an analytical approach, ensuring you’re making decisions based on data rather than solely on personal conviction.

Neglecting Market Research

Even experienced investors can underestimate the importance of thorough market research. Failing to analyze local market trends, property values, or upcoming developments can lead to poor investment choices. To make informed decisions, you should always be aware of the dynamics influencing your target market, including economic indicators, demographic shifts, and potential regulatory changes that can affect property values.

Understanding the local economy, neighborhood characteristics, and competition will empower you to identify quality investments better. The more in-depth your research, the clearer the picture you’ll have regarding potential growth and challenges. This diligence plays a critical role in ensuring you remain competitive and informed as you pursue your real estate goals.

Underestimating Costs

Assuming the costs associated with a property are limited to just the purchase price can lead to unsettling surprises down the line. You should account for various expenses, such as property taxes, maintenance, renovations, and management fees, that can quickly add up and erode your profits. Conducting a comprehensive analysis of all potential costs is important to making sound investment decisions.

Researching and itemizing every likely expenditure will provide you with a realistic understanding of the total cost of ownership. Evaluating past expenses of similar properties and consulting industry benchmarks can help ensure that your estimates are accurate. By taking the time to conduct thorough financial assessments, you’ll position yourself for success and avoid costly overreaching in your investment strategy.

Final Words

With these considerations, you have acquired the fundamental tools and insights necessary to identify high-potential real estate investments. Understanding market trends, recognizing the importance of location, and evaluating property conditions will empower you in making well-informed decisions. As you examine into the real estate landscape, utilize data analytics and thoroughly assess financial metrics to gauge the profitability of your potential investments. This systematic approach will not only enhance your investment portfolio but also mitigate risks associated with real estate ventures.

In your journey as a real estate investor, maintaining a proactive mindset and staying updated on market developments will serve you well. Engage with industry professionals, attend seminars, and continually educate yourself to refine your strategies. By applying the principles outlined in this dynamic how-to guide, you are well on your way to uncovering lucrative opportunities that align with your investment goals. Your diligence and strategic thinking will be key assets in securing successful real estate investments that can lead to long-term growth and financial stability.