Many new investors find the real estate market daunting and complex, but with the right strategies and knowledge, you can successfully navigate this exciting field. This comprehensive guide will walk you through the crucial steps, from understanding market trends and property evaluation to financing options and investment strategies. By empowering you with valuable insights and practical tips, you can build a solid foundation for your investment journey and make informed decisions that lead to profitable outcomes.

Understanding the Different Types of Real Estate Investments

Your journey into the real estate market can be rewarding when you understand the various types of investments available. Each type holds unique benefits and risks that can impact your investment strategy. By grasping these differences, you can make informed decisions that align with your financial goals. Here’s a breakdown of the primary types of real estate investments:

| Type of Investment | Description |

|---|---|

| Residential Properties | Investments in homes or apartments designed for individuals or families. |

| Commercial Properties | Properties utilized for business purposes, such as offices and retail spaces. |

| Industrial Properties | Real estate used for manufacturing, distribution, and storage. |

| Land | Raw, undeveloped land that can be held for appreciation or development. |

| Real Estate Investment Trusts (REITs) | Companies that own or finance income-producing real estate. |

Perceiving these distinctions will help you see where your interests and financial aspirations align within the real estate landscape.

Residential Properties

On the entry-level side of real estate investing, residential properties are often the most accessible for new investors. These typically include single-family homes, apartments, and condominiums, which you can rent out to tenants or sell for profit. Investing in residential real estate can offer you stable cash flow through rental income while also providing the potential for property appreciation over time. It’s crucial to conduct thorough market research to identify desirable neighborhoods and understand tenant demographics.

Additionally, consider the various financing options available for residential investments, such as traditional mortgages or FHA loans, which can make initial investments more approachable financially. If you strategically select properties that require minimal maintenance and are situated in high-demand locations, you can maximize your return on investment and reduce vacancy rates.

Commercial Properties

Real estate investments can take a different turn when you consider commercial properties, which encompass a wide range of uses, including office buildings, retail spaces, and industrial complexes. These types of investments often require a more significant initial capital outlay but can yield higher returns compared to residential properties. Understanding the market demand for commercial spaces in your target area is necessary, as well as comprehending the various lease arrangements, such as gross leases or net leases, that can affect your earnings.

Moreover, since commercial property investors usually enter into longer lease agreements with tenants, they can achieve more stable cash flow over time. The commercial real estate market may also be less volatile than the residential sector, leading to potentially advantageous appreciation rates. As you explore these opportunities, be sure to evaluate factors like location, zoning, and potential tenant quality.

It’s also necessary to stay updated on market trends and economic indicators that can affect commercial properties, such as changes in local industries or shifts in consumer behavior.

Real Estate Investment Trusts (REITs)

Properties can also be invested in through Real Estate Investment Trusts (REITs), which allow you to pool your money with other investors to purchase and manage a portfolio of real estate assets. REITs offer a hands-off investment approach since they are professionally managed and provide dividends to shareholders based on the income generated by the properties owned. This investment type is particularly attractive if you wish to diversify your real estate exposure without the responsibilities of direct property ownership.

Different REITs specialize in various sectors, including residential, commercial, healthcare, and industrial real estate, allowing you to select a focus that aligns with your investment strategy and risk tolerance. By investing in REITs, you can benefit from the liquidity of publicly traded shares while still gaining exposure to the real estate market, making them an excellent choice for new investors looking for flexibility and lower entry costs.

Key Factors to Consider Before Investing

Some crucial factors can guide you to make informed decisions before plunging into the real estate market. Having a good understanding of these factors can help you mitigate risks and increase your chances of a fruitful investment. Here are a few key considerations:

- Your financing options and budget

- Market trends and cycles

- Location and neighborhood quality

- Property condition and potential for value addition

- Local legislation and zoning laws

Assume that you evaluate these factors diligently to set a solid foundation for your investment journey.

Market Trends

To become a successful real estate investor, you need to keep a close eye on current market trends. Understanding these trends can help you identify the best time to invest and predict potential future fluctuations in property values. For example, in a seller’s market, where demand exceeds supply, properties may sell for more than their asking prices. Conversely, in a buyer’s market, you may find more affordable options and have the upper hand in negotiations. Familiarize yourself with terms like “appreciation” and “depreciation,” as they indicate how property values change over time.

Additionally, pay attention to economic indicators that can affect real estate prices, such as employment rates, average income levels, and interest rates. A booming economy generally leads to higher demand for housing, while economic downturns might cause property prices to drop. As an investor, you want to be aware of these cycles to make strategic investment choices.

Location and Neighborhood Quality

Consider the location of your potential investment property carefully. Location significantly influences property value and future appreciation potential. A property in a well-connected area with access to amenities like schools, parks, and shopping centers is likely to attract more interest from future tenants or buyers. Areas with low crime rates and good public transport options are also generally more desirable.

Take the time to explore neighborhoods where you plan to invest. Look for signs of growth, such as new developments, infrastructure improvements, or an influx of businesses. Areas experiencing revitalization often present excellent investment opportunities as property values may ascend over time.

Trends in neighborhood demographics can also provide valuable insight. Areas with a growing population or those attracting young professionals and families may yield higher returns. Assessing the local schools and public services can further indicate neighborhood quality, which directly impacts the property’s appeal.

Property Condition

Little considerations about the condition of the property can make a big difference in your investment decision. Evaluating whether the property requires extensive repairs or renovations can impact your initial investment and potential return. A well-maintained property may offer immediate rental income, while a fixer-upper could provide opportunities for value enhancement, albeit with additional time and financial commitments.

When conducting a property inspection, take note of crucial elements like the structure, roofing, plumbing, and electrical systems. Understanding these factors will help you estimate future costs you might incur for upkeep or renovation. Neighborhood considered, knowing how property conditions compare within the area can also assist you in negotiating a fair price. Identifying any urgent repairs needed can save you from unexpected financial setbacks after your purchase.

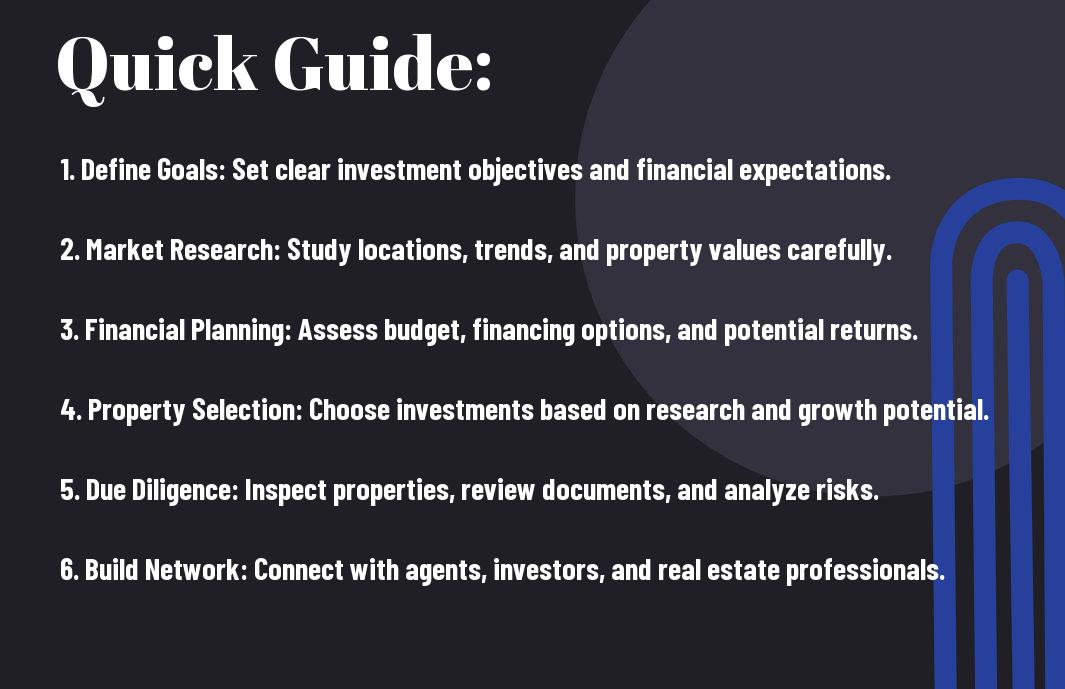

Step-by-Step Guide to Starting Your Investment Journey

Now that you’ve decided to venture into the real estate market, it’s time to navigate the necessary steps to kickstart your investment journey. Start by addressing some key elements that will help you lay a solid foundation for your investments. Below is a breakdown of these components that will frame your path forward:

| Steps | Actions |

| 1. Setting Your Investment Goals | Identify what you want to accomplish in real estate. |

| 2. Conducting Market Research | Analyze markets and trends to inform your investments. |

| 3. Building Your Investment Strategy | Create a plan tailored to your financial goals. |

Setting Your Investment Goals

Now is the perfect time for you to articulate your investment goals. Understand what motivates you to invest in real estate: Are you seeking passive income, doing it for long-term appreciation, or perhaps both? Define your financial targets, including the amount of capital you are willing to allocate and your expected return on investment. These personal insights will guide you throughout your journey and serve as a compass when faced with decisions.

Establishing your short-term and long-term objectives will also help you assess various property types, market conditions, and investment risks. Drawing a clear roadmap enables you to stay focused and adjust your strategy as needed along the way, providing a sense of accountability for achieving your desired outcomes.

Conducting Market Research

Research is a fundamental step that ensures you make informed decisions. Begin by exploring different markets, geographic locations, and property types that interest you. Pay close attention to trends, neighborhood demographics, local economic indicators, and pricing patterns. Wealth of information is available through various online platforms and resources, which can help you dissect the opportunities in the market.

Additionally, leveraging local real estate networks can provide necessary insights from experienced investors and professionals. Engage with online forums and social media groups, attend local workshops, and consider connecting with real estate agents who understand the nuances of the areas you’re interested in. The more diligent your research is, the more equipped you will be to seize lucrative investment opportunities.

A well-informed investor can navigate market fluctuations with confidence, making choices that align with their investment goals. This knowledge lays the groundwork for building a successful portfolio, ensuring you are prepared to respond to changes in market conditions and capitalizing on advantageous circumstances.

Building Your Investment Strategy

Guide your investment journey by creating a comprehensive investment strategy. This strategy should delineate your property acquisition criteria, the investment financing methods you intend to utilize, and the frameworks for managing your assets once acquired. Think through whether you prefer to invest in residential or commercial properties, and what level of involvement you desire — whether active management or a more hands-off approach through rental property management services.

Constructing a well-defined strategy allows you to evaluate potential deals consistently and helps mitigate risks throughout your investment journey. Furthermore, your strategy should be flexible enough to adapt as market conditions evolve and your personal goals change, ensuring you remain aligned with your overarching investment objectives.

Understanding your risk tolerance and available resources will also play a significant role in how you devise your strategy. It’s necessary to factor in your financial capabilities when developing your investment approach, as this will help dictate the types of investments you can make and the viability of your long-term objectives.

Essential Tips for New Investors

Keep a few crucial tips in mind as you venture into the world of real estate investing. Understanding the market dynamics and being prepared can significantly impact your success as a new investor. Here are some core strategies to keep you on the right path:

- Research local market trends

- Create a clear investment strategy

- Be aware of financing options

- Start small before scaling up

- Stay organized and keep detailed records

Perceiving potential opportunities and pitfalls will be key to your growth in this competitive landscape.

Networking and Building Relationships

An crucial aspect of thriving in real estate is networking and building relationships within the industry. You would benefit from connecting with other investors, real estate agents, and professionals who can guide you through your investment journey. Attend local real estate meetings and seminars, join online forums, and utilize social media platforms to reach out to like-minded individuals who can provide invaluable insights and connections.

In addition to making friends in the field, you can establish partnerships that may open doors to new opportunities. Whether it’s co-investing on a property or sharing resources, having a solid network can be the backbone of your success. This relational capital not only enhances your knowledge but can also lead you to great deals that you might not find on your own.

Seeking Professional Help

Networking with experts can also extend to seeking professional help when needed. As you navigate the intricacies of real estate, it may become apparent that certain areas demand specialized knowledge. Whether it involves hiring a financial advisor, an attorney, or a property manager, having a team of professionals can help protect your interests and streamline your investment process.

Another crucial factor is knowing when to seek assistance, particularly with legal issues or property evaluations. These professionals bring a wealth of experience that can save you from costly mistakes and guide you through complex transactions. Their input can ensure you make informed decisions, which can significantly impact your investment’s profitability.

Continuous Education

To stay competitive in the ever-evolving real estate market, committing to continuous education is vital. Take the time to read books, attend workshops, or take online courses that cover various aspects of real estate investing. By learning about market trends, financing options, and emerging strategies, you position yourself as a knowledgeable investor who can adapt to changing circumstances.

The desire to keep learning can also lead you to explore different niches within real estate, allowing you to find the best fit for your investing style. Engaging with all available resources helps build your confidence and expertise, ultimately leading to smarter investment choices.

Pros and Cons of Investing in Real Estate

To be an informed investor, it’s important to weigh the pros and cons of real estate investment. This analysis will help you decide if this investment avenue aligns with your financial goals and risk tolerance. Below is a breakdown of the advantages and disadvantages you may encounter in your real estate journey.

| Advantages | Disadvantages |

|---|---|

| Potential for rental income | High entry costs |

| Appreciation over time | Market fluctuations |

| Tax benefits | Maintenance and management responsibilities |

| Diversification of investment portfolio | Illiquidity of assets |

| Leverage opportunities | Potential for property devaluation |

| Passive income potential | Legal and regulatory risks |

| Inflation hedge | Time-consuming market research |

| Control over investment | Tenant-related issues |

| Wealth-building strategy | Emotional stress from decision-making |

Advantages of Real Estate Investment

One of the noteworthy advantages of investing in real estate is the potential for generating consistent rental income. When you own property, you can earn monthly cash flow, which can provide financial stability and serve as a source of passive income. Additionally, real estate is known for its capacity to appreciate over time, allowing you to build wealth as property values increase. This characteristic can significantly enhance your overall investment portfolio.

Moreover, investing in real estate offers various tax benefits that can further improve your bottom line. Deductions for mortgage interest, property taxes, and depreciation can lead to considerable savings, allowing you to optimize your returns. As a tangible asset, real estate also provides a hedge against inflation, meaning that as the cost of living rises, so too does the value of your investment, protecting your purchasing power.

Potential Risks and Disadvantages

An important aspect to consider is the potential risks and disadvantages associated with real estate investment. The real estate market is susceptible to economic fluctuations, which can lead to changes in property values and rental demand. High entry costs can also deter you from investing, as significant capital is often required to purchase not only the property but also to cover related fees and ongoing maintenance.

Potential risks include issues such as property devaluation and the complexities of managing tenants. Being a landlord comes with responsibilities that can be both time-consuming and emotionally taxing. Legal and regulatory challenges may arise, adding another layer of complexity to your investment strategy. As you navigate the real estate market, being aware of these risks can help you make informed decisions that align with your financial objectives.

Common Pitfalls to Avoid as a New Investor

Unlike seasoned investors, new investors often fall prey to numerous pitfalls that can hinder their success in the real estate market. Awareness of these common traps is vital for maintaining the integrity of your investment journey. By recognizing and steering clear of these issues, you can enhance your strategy and improve your chances of thriving in the real estate arena.

Overleveraging Investments

One primary mistake you should be wary of is overleveraging your investments. It’s tempting to use borrowed funds to acquire more property, especially when you believe the market is favorable. However, this could lead to substantial risks. If property values happen to decline or if you face unexpected expenses, your ability to service loans could be compromised, potentially leading to severe financial consequences.

Neglecting Due Diligence

Even the most compelling property deals can come crashing down if you fail to conduct due diligence. Skipping this step can lead to unforeseen issues with the property itself, such as zoning restrictions or structural damage that could incur costly repairs. A thorough examination of all relevant documentation and property conditions should be a standard part of your investment protocol.

It’s crucial to research not only the property but also the surrounding area. Look into local market trends, crime rates, schools, and potential for future development. This will provide you with a clearer picture of whether your investment will appreciate over time or become a financial liability.

Ignoring Market Changes

Little attention to market fluctuations can lead to significant pitfalls in your investment strategy. The real estate market is dynamic; what seems like a lucrative deal today may not hold the same value tomorrow. You need to stay attuned to market trends, including shifts in interest rates, economic indicators, and changes in buyer behaviors that can significantly impact property values.

Another factor to consider is how broader economic conditions can influence local markets. A downturn in the economy, for example, could lead to reduced demand for rental properties, affecting your cash flow. By keeping yourself informed about these changes, you can make more strategic decisions and better time your own buying or selling moves in the market.

Final Words

The journey of navigating the real estate market as a new investor can be both stimulating and challenging. By arming yourself with knowledge about market trends, financing options, and property management, you can make more informed decisions that lead to successful investments. It’s imperative to stay adaptable and keep abreast of any changes in the market landscape, as this will enhance your ability to spot opportunities and mitigate risks.

Your success in real estate investing largely depends on your willingness to learn and take calculated risks. Engage with mentors and local networks to build supportive relationships that can provide valuable insights. With time and dedication, you can cultivate a portfolio that aligns with your investment goals, ultimately leading to financial growth and stability in your future endeavors. Trust in the process, and soon you’ll find yourself navigating the real estate market with confidence and expertise.